Right before writing this article, I looked at the US National Debt Clock, which I’ll get to it in a minute. It’s startling, but I’m here to tell you deficits and national debt just don’t matter. In a world awash with liquidity, central banks have already announced a flood of $9 trillion – with more banks still to announce. Under-reported in Washington’s bipartisan largesse is GOP silence on behalf of American ownership. Translation: voodoo economics won, and asset yields are going down.

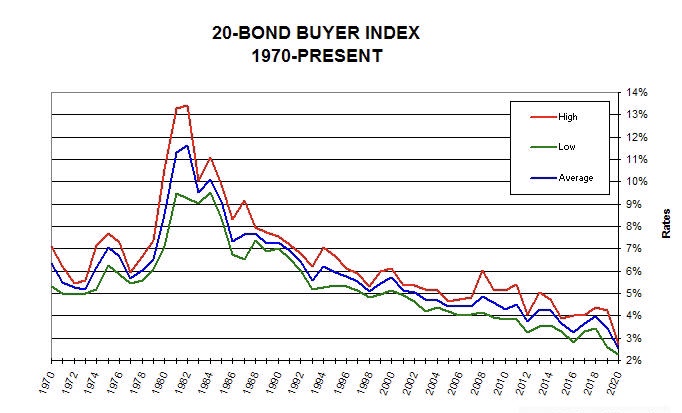

Whereas the average tax-free municipal bond yield in 1982 was 11.5 percent, it is 2.5 percent today. What happened? To be blunt, public entities don’t need the private loan. Not when alums will donate $2 billion to UNC, new property-tax payers will move to Florida, and the federal government will grant large sums to state and local governments. Sadly, cheap federal funds allow banks to lower CD yields and money managers to justify lower portfolio yields.

The moral of the story is this: mothers, don’t let your sons grow up to be idle rich. It just doesn’t pay, so teach them to do or make something the consuming masses want – poolside Pina Coladas don’t count – because even Republicans are populists now. This is true and, while Bernie Sanders would rob us with a six gun, Trump is doing it with a fountain pen. I’m not bashing President Trump, because he’s doing the right thing. I am, however, suggesting capitalism is forever changed.

Back to the National Debt Clock. This year’s federal budget deficit is already $1.6 trillion, and the national debt is now $23.6 trillion (which is 109% of America’s annual GDP). Total US debt is now $76.9 trillion, and un-funded US liabilities are $132.1 trillion. In spite of this, global investors are rushing to the safety of the US dollar (e.g. 60% of foreign bank reserves and 40% of all debt are now held in US dollars). You might wonder why, and the answer is simple: because America still does and makes what global customers want.

In principle, American populism is not a bad thing (unless it includes the Green New Deal) because its central tenet is we the people are the only care of markets and governments. But – it does mean workers and payrolls matter matter more than owners and dividends. The $2 trillion CARES Act makes this crystal clear: Washington will fund commissions, salaries and wages only if companies agree to forego cash distributions to the company’s owners for at least one year.

Don’t worry, because the macro-economics of debt threatens Greece more than America. To wit, after ouzo and olives, name a viable Greek export. US debt is a forward-looking bet on the US economy, and I’d take the over on America against any other economy. China has yet to surpass the USA as home to the best and brightest, while President Trump and COVID-19 guarantee China won’t be “home” to American manufacturing for too much longer.

Do re-think your home economics because cheap money requires owners to adjust their investment strategies. At 2.5% interest, a millionaire on fixed income is not achieving the poverty rate in some localities. A Greenwich house is now a liability (carrying costs exceed the interest on the discount required to sell it), while a Palm Beach mortgage is an investment (rising demand). But here’s my point: the real estate agents will divide up to $120,000 when you sell and buy those $1 million homes. Who’s the new economy winner here?

My Home Economics tutorial concludes with the cast of Gilligan’s Island. Go long the professor and Mary Ann, but short the millionaire and Lovey. While Mary Ann and the professor are turning coconuts into pies and electric batteries, Thurston’s playing with a coconut and polo mallet. That’s the US economy of the future: passive asset-owners will talk about what daddy did, while the doers and makers prosper.