The question is simple: would you rather have an ice-cold Corona or catch the Coronavirus? This is the macro-hurdle now facing the People’s Republic of China and its manufacturing dominance. Think back to Commerce Secretary Ross’s initial reaction: “I think it will help to accelerate the return of jobs to North America, some to US, probably some to Mexico as well.” He knows why American manufacturing left and how China cheats; so, bet the over on Mexico, mi amigo!

In the mid-nineties, I moved jobs from California, Canada, North Carolina, and Virginia to China. Twenty years later, my company began moving production to Vietnam because Chinese costs were inflating. Last year, Trump’s trade tariffs further drove us out of China and into India, Malaysia, Mexico, the Philippines, Taiwan, the US and Vietnam – with no plans to return to China. This is typical of many American businesses.

The global supply chain buys so many components from Chinese factories, the Covid-19 outbreak was a rude awakening to companies worldwide. Chinese supply-chain math is simple: one missed day ruins the week, one missed week ruins the month, one missed month ruins the quarter, and one missed quarter ruins the year. Thus, the negative guidance from Apple and other Fortune 500s.

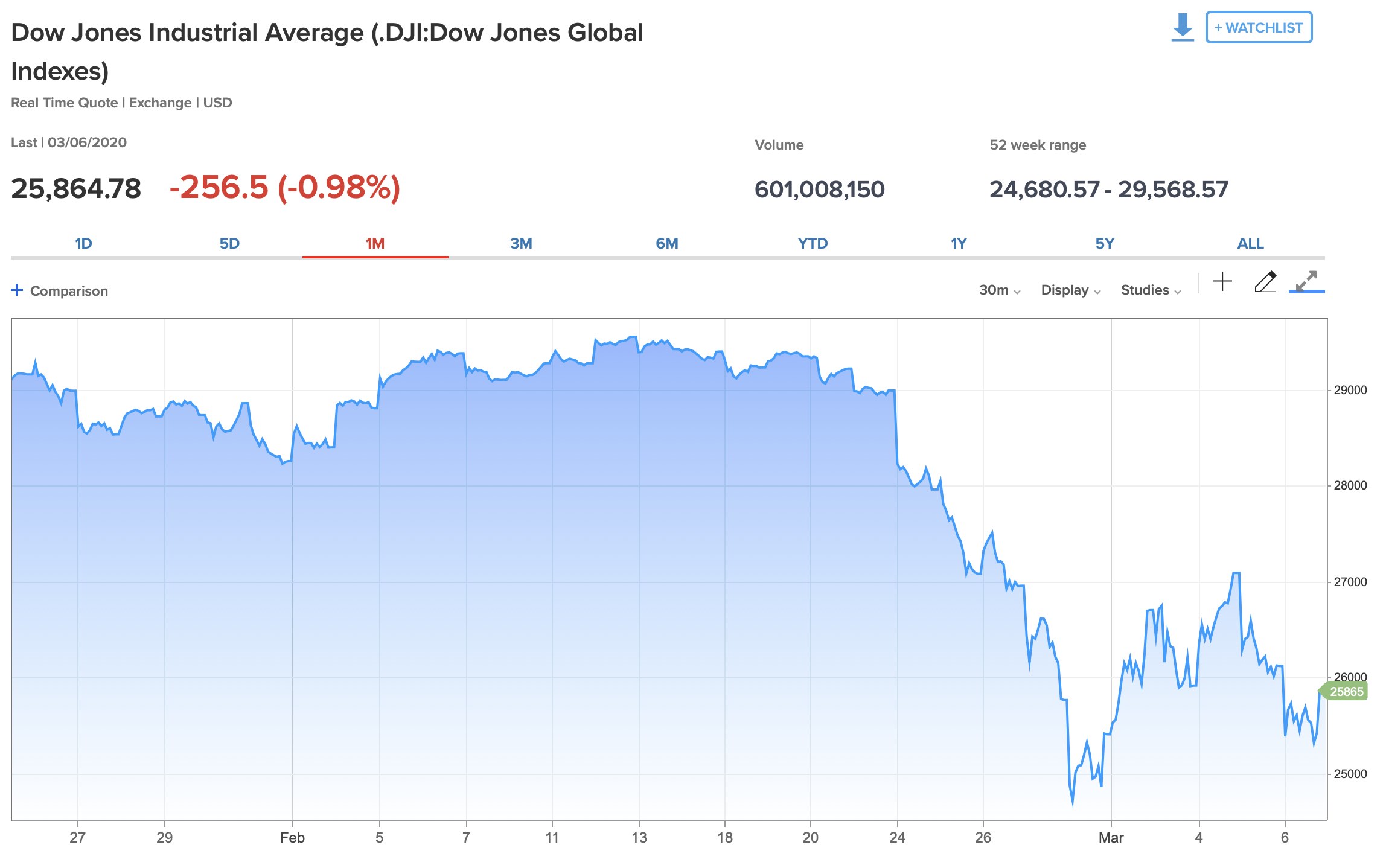

After the deaths that resulted from Covid-19, the great tragedy is the economic panic that sent the S&P 500 down 11% and ruined the near-term prospects for travel and leisure businesses. This takes us back to Wilbur Ross and the pot of gold at the end of the rainbow. Business leaders, especially in North America, know three things: (1) SARS and Covid-19 originated in China, (2) pandemics create economic panic, and (3) it is time to leave China

The goal of the USMCA is twofold: (1) create a free-trade zone that dwarfs China and (2) deny China manufacturing hegemony. It’s important to America’s economy that “our” trade zone remain predictable (e.g. control 5G), and that Chinese components don’t control USMCA industries (e.g. automobiles). The observation here is that North America has entered a post-China industrial renaissance.

Mexico’s minimum wage is $0.66 per hour ($0.80 in China) and shipping a container from Mexico to New York takes 5 days (40 days from Shanghai). Plus, doing business in Mexico is an overnight trip – not an overnight flight. Forbes reports foreign direct investment being diverted to Mexico is now at least $12 billion annually. Last but not least, a growing Mexican economy would solve the border crisis without a single Democrat vote.

The USA and China are economic, military and political rivals – and the two societies are incompatible. Whereas Americans are free and fanned across a continent, the Chinese are muzzled and clustered in quasi-gulags on the eastern coast. This is a bad social contract: export American jobs to densely populated manufacturing centers in exchange for the joy of buying Chinese goods at Wal-Mart and the fear of Covid-19. In other words, I’d bet the under on China, Grasshopper!