We have never seen so many booms and busts occurring almost simultaneously. In that kind of environment, you can’t really plan — you just have to guess, and 2022 will be known as the year when many businesses and portfolio managers guessed dead wrong.

Jim Cramer (CNBC)

A chief executive should at least shoot straight, so this president scares me. To wit, he recently told reporters, “Today, we received news that our economy had zero percent inflation in the month of July – zero percent.” As if nobody knows inflation is running at 8.5% and the Fed’s aggressive money tightening is not done.

The world economy is at a tipping point, with “expert” economists predicting boom AND recession, as well as deflation AND inflation. CNBC’s Jim Cramer rightly cites “booms and busts occurring almost simultaneously.” There’s low unemployment AND too many unfilled jobs, an energy crisis AND oil glut, and record personal debt despite government “helicopter cash” raining down on households. So, hold onto your wallet.

Go to Biden for Lagging Indicators

Biden sowed the seeds of inflation and recession, so he views 528,000 new jobs in July and 3.5% unemployment as vindication. Sadly, these are lagging economic indicators (like corporate earnings, strength of the dollar, and the falling price of gold and silver) that are not actually predictive. July employment is not “good” because 99.9 million Americans aren’t “participating” in the job market (the 62.1% workforce participation rate). 152.5 million jobs met the pre-pandemic high, but full recovery should have been 157 million jobs in February 2022 (see chart below).

2.2 million new jobs per year (the 10-year average) are needed to accommodate US business and population growth; so, 11.3 million unfilled jobs and 5.5 million who should be working are the real (untold) story.

There’s a back story to this administration’s economic indicators. Stronger-than-expected Q2 corporate earnings owe as much to fleeting pricing power and federal stimulus – all pandemic related – as to other factors. The dollar’s 14% gain against a broad basket of currencies is the result of the Fed tightening monetary policy more aggressively than other central banks. Gold and silver prices dropped in response to rising interest rates and stronger dollar.

So, what isn’t the President saying?

Look Elsewhere for Leading Indicators

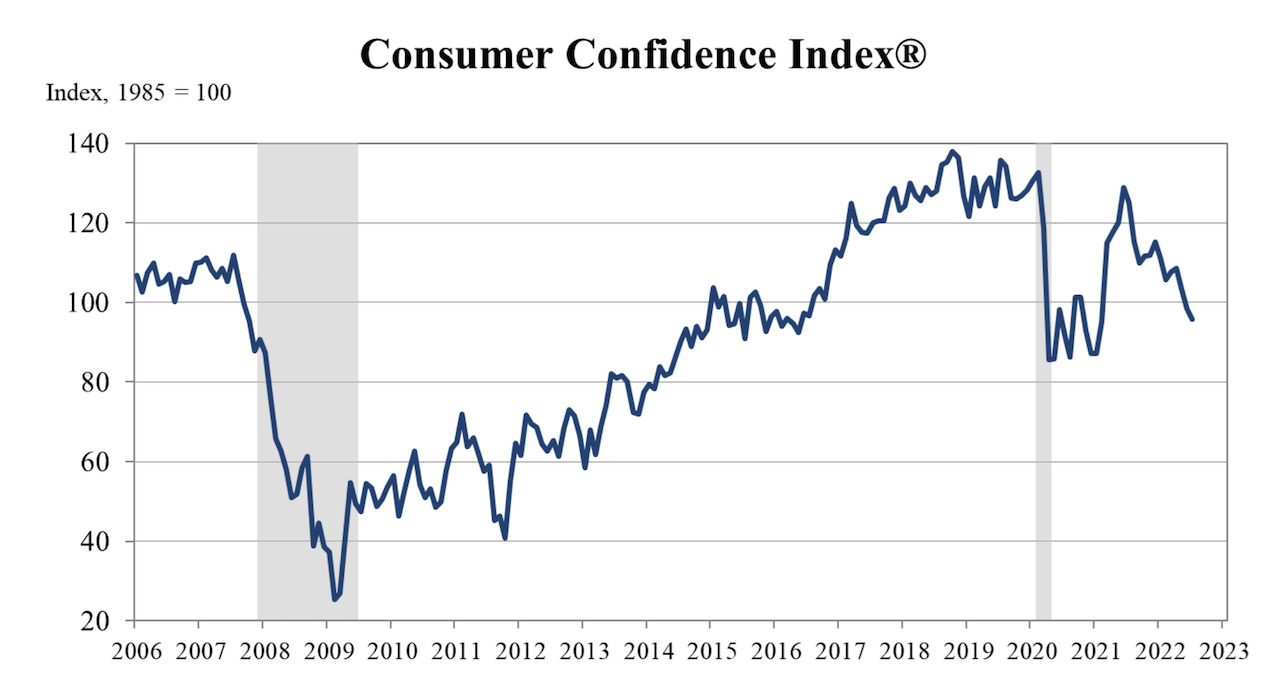

One, the Conference Board consumer confidence index (at top of post) dropped 2.7 points in July, as did the present situation and expectations indices. CB director Lynn Franco: “Consumer confidence fell for a third consecutive month. Purchasing intentions for cars, homes, and major appliances all pulled back further in July.”

Two, housing sales and starts don’t lie. July sales are down 20% against 2021 and 6% compared to June, explained by the NAHB: “Federal Reserve (raising rates) and persistently elevated construction costs have brought on a housing recession.” The seasonally adjusted annualized sales rate of 4.81 million units is the worst in 7 years, explained to CNBC by Realtors: “we are surely in a housing recession because builders are not building.”

Three, the New York Fed’s business conditions index registered the 2nd largest monthly decline on record this month. After expecting a reading of plus-5 (anything below zero portends recession), the index fell 42.4 points to negative 31.3 (shipments fell 49.4 points). The Philadelphia Fed reported a similar reading, and neither bank expected the steep drop-off in new business (orders in the NY index fell 35.8 points).

Four, the New York and Philadelphia Fed findings are not one-of manufacturing reports. Unfilled orders have fallen 3 months in a row, the prices-paid index (55.5) hit a 12-month low, the July ISM barometer of US factories fell to a two-year low (52.8%), Asian factories are scrambling for orders, and spot prices for ocean containers have dropped to under $10,000. These are red-flag leading economic indicators – not White House happy talk.

A Bad Time for Trouble Abroad

Europe’s largest economy, Germany, has stagflation; rising costs, slumping growth, and low morale because of the Ukraine war. In July, producer prices (a leading indicator for inflation) spiked 37.2%, and the 5.3% month-on-month jump was the highest ever recorded. The EU is frozen with fear over Russia, natural gas prices are approaching record levels, and this winter will be costly.

Asia’s largest economy, China, was described by the Financial Times as a “desperate situation” on August 15. Rural banks have begun freezing checking accounts; 400,000 and rising. Steel production is down, the real estate and banking crisis – owners refusing to pay mortgages on unfinished homes and apartments under contract – continues, and Taiwan is just there for the taking.

And what of the American-led boycott of Russian oil and gas? China and India are buying all the petrol Putin can ship (nothing like a nuclear arsenal to cut the US down to size). I cannot think of a worse time to stifle US domestic energy production and rack up unprecedented debt. The USA spent $6.4 trillion in the War On Terror (source: CBS News). What would wars with China or Russia cost?

A Bad Time for Too Much Debt

This is the wrong time for the US economy to incur too much government, business, and personal debt. There are 56.7 million retirees (and growing) that draw Social Security ($22.1 trillion liability) and Medicare ($34.4 trillion liability). When total federal unfunded liabilities are $170.9 trillion, and the population is rapidly aging, our government should not spend recklessly. But it is.

Annual Federal outlays increased from $4.4 trillion in 2019 to $7.2 trillion in 2021, causing Federal debt to balloon from $22.7 trillion to $29.6 trillion. At the same time, total debt held by the public rose from $16.8 trillion to $23.6 trillion, meaning total US debt is now $92.1 trillion (source: US Nation Debt Clock).

Michael Burry, the Big Short investor, has been warning about market crashes, because total US personal debt increased from $17.4 trillion in 2020 to $23.6 trillion today. And, despite trillions in “helicopter cash” from the federal government, consumer borrowing spiked $40.2 billion in June; convincing Burry to dump all but one prison stock from his portfolio.

Winter Is Coming

If you’re keeping score at home, that’s $92.1 trillion in debt on the balance sheet and $170.9 trillion in debt off the balance sheet. No wonder Democrat economist Larry Summer warned Biden against too much stimulus and now predicts a recession within “two years because of the magnitude of the inflation we’ve built up.”

He’s not alone, JPMorgan’s Jamie Dimon just said there’s a 90% chance of at least a mild recession (source: Yahoo Finance). Bank of America CEO Brian Moynihan recently called out Biden’s happy talk, telling reporters that the President’s denials mean less than “what it feels like for the people going through this.”

Maybe Moynihan should be president, because the polls prove Biden is out of touch. Morning Consult found 65% of registered voters and 67% of private-sector employees say the US economy is in recession. The latest TIPP poll found 51% of Democrats, 56% of Independents, and 74% of Republicans say the US is in a recession. These are the people that do the borrowing and buying (and voting).

I gotta confess I hate writing a buzzkill post. But, what I hate more is a president so worried about keeping his job, he does not do the most important part of his job: telling his fellow Americans the unvarnished economic truth so they can plan for their businesses and households.

Larry Cramer nailed the real problem: Americans “can’t really plan, have to guess, and many (will) guess dead wrong.”